Benefits Calculator

Estimate your pension benefits for retirement.

Agenda / Minutes

View the latest from our recent board meetings.

News

Find out what is happening at KCPERS.

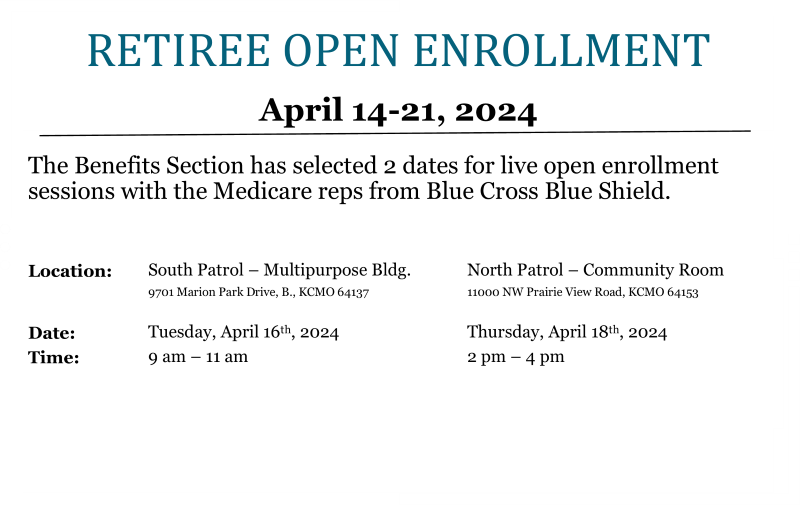

Events

Mark your calendar for our next event.

Meeting Reminder

Forms

Need to make a change? Our form library will help you to get started.